When you think of storing value over time, most people picture gold-shiny, heavy, and trusted for thousands of years. But now, there’s another option: Bitcoin. It’s not metal. It doesn’t sit in a vault. Yet, more and more people are treating it like money. So which one actually works better? Let’s cut through the noise and compare Bitcoin and gold on the three things that really matter: volatility, scarcity, and portability.

Scarcity: Fixed Supply vs. Mining Limits

Gold is rare. There’s only about 212,000 tons of it above ground, and we mine about 3,000 more tons every year. That’s a 1.5% to 2% increase in supply annually. It sounds small, but it’s real. New discoveries in Australia, Canada, or Africa mean more gold enters the market. Even if it’s slow, the supply isn’t locked in.

Bitcoin is different. Its supply is mathematically capped at exactly 21 million coins. No one can change that. Not a government. Not a company. Not even the developers. As of October 2024, about 19.58 million BTC have already been mined. That leaves just over 1.4 million left to be created-and they’ll come slower and slower thanks to the 2024 halving. After that event, miners earn just 3.125 BTC per block instead of 6.25. By 2140, no new Bitcoin will be created. Zero. That’s absolute scarcity. Gold can be found. Bitcoin can’t be copied or printed. It’s finite by design.

Portability: Send It Across the World in Seconds

Imagine you need to move $1 million in value. With gold, you’d need a truck. A secure, armored, insured truck. Companies like Brink’s charge between $2,500 and $5,000 to move that much. It takes days. You need paperwork. Customs. Security clearances. Even if you’re moving it across town, it’s expensive and slow.

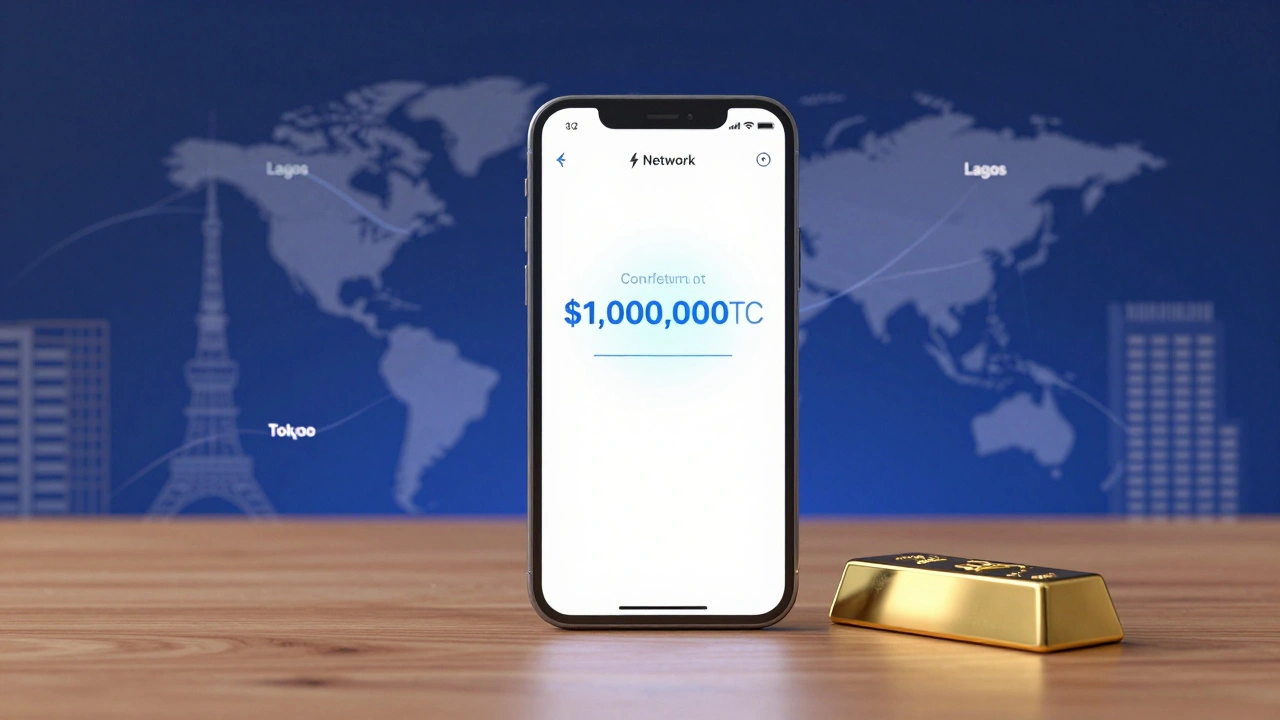

With Bitcoin? You open your phone. You type in the address. You hit send. The transaction confirms in about 10 minutes. If you’re using the Lightning Network, it’s under a second. The cost? Less than a dollar. You can send $1 million from Asheville to Tokyo while you’re waiting for your coffee. No one needs to know you’re moving it. No forms. No insurance. Just a private key and an internet connection.

This isn’t theoretical. In 2024, a user on Reddit moved $50,000 in Bitcoin from California to Nigeria in 47 seconds. The same amount in gold would’ve required shipping, customs clearance, and a 7-day wait. That’s the difference between a 5,000-year-old system and one built for the digital age.

Volatility: The Price Rollercoaster

Here’s where Bitcoin gets messy. In 2024, Bitcoin’s annualized volatility was 51%. That means its price swings up or down by over 50% in a year. Gold? Around 14%. That’s less than a third. Bitcoin doesn’t just move with the market-it leads it. When tech stocks crash, Bitcoin often crashes harder. In 2022, Bitcoin dropped 64% while gold rose 12%.

But here’s what most people miss: Bitcoin’s volatility is falling. In 2017, it was 10 times more volatile than gold. Now it’s just 3.6 times. Why? Because more institutions are holding it. After Bitcoin ETFs launched in January 2024, over $15 billion poured in. Big money doesn’t trade like a speculator. It holds. And that’s calming the market. NYDIG’s models predict Bitcoin’s volatility will drop another 8% per year. By 2030, it could be within striking distance of gold’s levels.

Gold doesn’t jump. It creeps. It’s stable because it’s old. Bitcoin’s swings are loud because it’s new. But stability isn’t always better. If you’re holding for 10 years, volatility matters less than whether your asset will be worth more at the end. Bitcoin’s price has gone up 10,000% since 2017. Gold? About 150%.

Real-World Use: Who Uses What and Why?

Millennials and Gen Z? They’re buying Bitcoin. A Harris Poll in August 2024 found 54% of U.S. millennials prefer Bitcoin because it’s digital, fast, and easy to access. They don’t want to store bars in a safe. They want to hold it in an app. For them, Bitcoin isn’t just money-it’s control.

Older investors? Many still trust gold. Baby boomers made up 67% of those in the same poll who chose gold. Why? Because they’ve seen markets crash. They’ve seen banks fail. They’ve held physical gold through inflation, war, and recession. They know they can touch it. They know it won’t disappear if their phone dies.

And then there’s the dark side. One in five Bitcoin owners has lost access to their coins. Lost a password? Forgot a seed phrase? Gone forever. Chainalysis says 19% of users have permanently lost funds. That’s real. But gold has its own risks. If you bury a bar in your backyard and forget where, it’s gone too. And if you buy from a shady dealer, you might get fake bars. Professional testing costs $50 to $200 per bar. Bitcoin doesn’t need that. You verify it on the blockchain-no expert needed.

Who Holds It? Institutions and Central Banks

Central banks hold $2.5 trillion in gold. That’s not a coincidence. Gold is the default reserve asset. It’s accepted everywhere. No one questions it. Even if the dollar collapses, gold still has value.

Bitcoin? It’s the new kid. But it’s growing fast. Since January 2024, Bitcoin ETFs have brought in over $15 billion. Fifteen percent of Fortune 500 companies now hold Bitcoin on their balance sheets. MicroStrategy owns over 200,000 BTC. Tesla still holds some. Even countries like El Salvador have made Bitcoin legal tender.

Gold is still king in the vaults. But Bitcoin is in the code. And code is easier to scale. You can’t split a gold bar into a billion pieces. But you can split Bitcoin into 100 million satoshis. That’s why Bitcoin works for micropayments. You can send $0.0000005 in Bitcoin. You can’t do that with gold.

The Bottom Line: It’s Not Either/Or

Gold isn’t dying. Bitcoin isn’t replacing it. They’re different tools for different jobs.

Use gold if you want something physical, slow-moving, and trusted by governments. Use it when you’re worried about the entire system collapsing. It’s your insurance policy.

Use Bitcoin if you want something fast, global, and programmable. Use it if you believe in digital ownership, censorship resistance, and scarcity that can’t be altered. It’s your upgrade.

Some people hold both. That’s smart. Gold gives you calm. Bitcoin gives you growth. One is ancient. One is future-proof. You don’t have to pick one. You just need to understand what each does best.

What’s Next?

By 2030, Ark Invest predicts Bitcoin could hit $1.5 million per coin. That’s based on adoption, scarcity, and institutional demand. Ray Dalio still says gold is the ultimate safe haven. Both might be right.

Bitcoin’s supply is fixed. Gold’s isn’t. Bitcoin moves instantly. Gold doesn’t. Bitcoin is volatile now, but it’s getting calmer. Gold is calm now, but it’s not growing.

The real question isn’t which is better. It’s: What do you need your money to do?

Is Bitcoin more scarce than gold?

Yes. Bitcoin has a hard cap of 21 million coins, and no more will ever be created. Gold’s supply increases by 1.5% to 2% each year due to new mining. Bitcoin’s scarcity is mathematically guaranteed. Gold’s is physical and subject to discovery.

Can Bitcoin be as stable as gold?

It’s getting closer. Bitcoin’s volatility was over 10 times gold’s in 2017. By 2024, it was 3.6 times higher. Institutional adoption through ETFs and longer-term holding is reducing swings. Models suggest Bitcoin’s volatility could drop 8% per year. It won’t match gold’s stability overnight, but it’s trending that way.

Is Bitcoin easier to move than gold?

Far easier. Moving $1 million in Bitcoin costs less than $1 and takes minutes via the Lightning Network. Moving the same value in gold requires armored transport, insurance, customs, and 3-5 days. It costs $2,500-$5,000. Bitcoin wins on speed, cost, and accessibility.

What happens if I lose my Bitcoin private key?

If you lose your private key or seed phrase, your Bitcoin is gone forever. There’s no customer service, no reset button. That’s why secure storage-like hardware wallets or multi-sig setups-is critical. Gold can be lost too, but you can often prove ownership through receipts or appraisals. Bitcoin’s irreversibility is a feature, not a bug-but it demands responsibility.

Should I buy Bitcoin or gold in 2025?

It depends on your goals. If you want long-term value storage with minimal volatility and physical tangibility, gold is still the safer bet. If you believe in digital ownership, global accessibility, and potential for higher growth, Bitcoin offers unique advantages. Many investors hold both to balance risk and opportunity. The key is understanding what each asset does best-not forcing one to be the other.

James Winter

December 5, 2025 AT 10:17Aimee Quenneville

December 6, 2025 AT 18:47Cynthia Lamont

December 7, 2025 AT 13:59Kirk Doherty

December 8, 2025 AT 05:30Dmitriy Fedoseff

December 8, 2025 AT 22:25Meghan O'Connor

December 10, 2025 AT 07:41Morgan ODonnell

December 11, 2025 AT 23:56Liam Hesmondhalgh

December 12, 2025 AT 09:20Patrick Tiernan

December 13, 2025 AT 22:29Patrick Bass

December 15, 2025 AT 07:21